Major financial institutions across Nigeria have begun notifying their customers of significant changes to electronic transfer charges, as new provisions of the Nigeria Tax Act 2025 come into force. The key update is the introduction of a N50 stamp duty levy on all electronic transfers of N10,000 and above, effective from Thursday, January 1, 2026.

Key Changes and Bank Communications

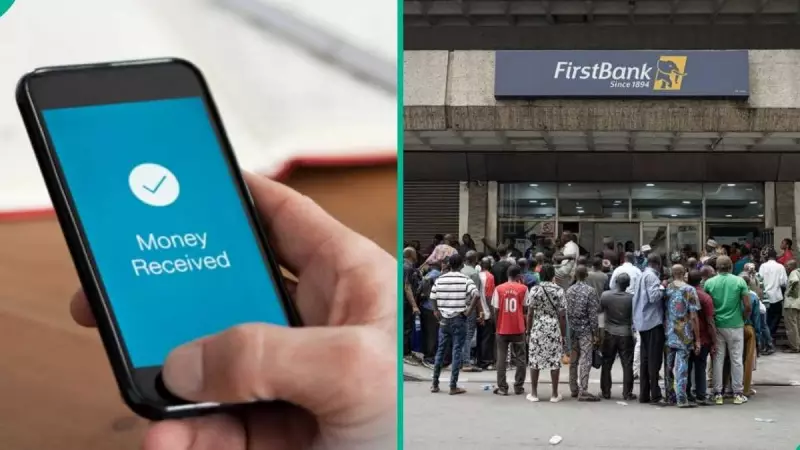

In a series of advisories sent to customers, banks including Access Bank, First Bank, Guaranty Trust Bank (GTB), United Bank for Africa (UBA), Wema Bank, and Zenith Bank clarified the new rules. A critical shift is that the N50 charge will now be borne by the sender of the funds, not the recipient as was previously the case for some levies. The banks have emphasised that this stamp duty is a separate charge from the regular transfer fees and will be clearly displayed to customers at the point of initiating the transaction to ensure transparency.

Access Bank informed its customers: "The New Tax Act (NTA) 2025 will take effect on January 1, 2026. The N50 Electronic Money Transfer Levy (EMTL) on money transfers will now be referred to as Stamp Duty. Transfers below N10,000, salary payments, and intra-bank self-transfers are exempt. The sender now bears the charge."

Similarly, GTBank's communication stated: "Following the new Nigeria Tax Act 2025... the N50 stamp duty on electronic transfers of N10,000 and above will be paid by the sender. Transfers below N10,000, salary payments, and intra-bank transactions between accounts within GTBank will not attract the charge."

Exemptions and Legal Recognition of Digital Agreements

The banks have uniformly highlighted important exemptions to the new stamp duty. Transactions below N10,000 will not attract the levy. Furthermore, salary payments and transfers between accounts held by the same customer within the same bank (intra-bank transfers) are also exempted from the N50 charge.

In a related development under the same tax law, electronic contracts and loan agreements have now gained full legal recognition in Nigeria. This move is expected to streamline digital business processes. However, general agreements executed electronically will attract a flat stamp duty of N1,000.

UBA's notification to clients included this point: "Electronic contracts and loan agreements are now fully recognized under the law." Wema Bank encouraged customers with inquiries to contact their customer service via phone or email.

Broader Context of Fiscal Reforms

This change in electronic transfer charges is part of a broader set of fiscal and tax reforms being implemented by the Nigerian government. The banks stated that the adjustments aim to improve transparency, protect digital transactions, and help customers understand all charges upfront. The reforms are also designed to strengthen compliance and boost revenue collection within the country's financial sector.

This follows an earlier report that the Federal Government, through the Presidential Committee on Fiscal Policy and Tax Reforms chaired by Taiwo Oyedele, has directed banks to collect Tax Identification Numbers (TIN) from all taxable account holders. This measure is also set to take effect on January 1, 2026, as part of a comprehensive effort to widen the tax net and formalize the economy.

The simultaneous rollout of the N50 stamp duty and the TIN collection mandate signals a significant shift in Nigeria's financial regulatory landscape, with a clear focus on increasing government revenue from digital transactions and improving fiscal data.