A Federal Capital Territory High Court in Abuja has dismissed a lawsuit that sought to stop the implementation of Nigeria's new tax laws, which are scheduled to commence on January 1, 2026. The ruling, delivered by Justice Bello Kawu, effectively clears the final legal hurdle for the controversial fiscal reforms to take effect as planned by the Federal Government.

Court Rejects Bid to Halt Tax Regime

The suit was filed by a group known as the Incorporated Trustees of African Initiative for Abuse Public Trustees. The plaintiffs had requested an interim injunction to restrain the Federal Government, the Federal Inland Revenue Service (FIRS), and the National Assembly from implementing the new tax framework.

In their application, the group specifically sought to stop the enforcement of four key pieces of legislation: the Nigeria Tax Act 2025, the Nigeria Tax Administration Act 2025, the Nigeria Revenue Service Establishment Act 2025, and the Joint Revenue Board of Nigeria Establishment Act 2025. They argued that there were discrepancies in the newly gazetted laws.

The defendants named in the case included the Federal Republic of Nigeria, the President, the Attorney General of the Federation, the Senate President, the Speaker of the House of Representatives, and the National Assembly itself.

Judge Cites Lack of Legal Grounds for Injunction

In his ruling delivered on Wednesday, December 3, Justice Bello Kawu found that the applicants failed to establish sufficient legal grounds to justify halting laws that have already been enacted and officially published. The judge stated that the application did not meet the necessary legal threshold required for granting an interim injunction.

The court held that the plaintiff did not demonstrate how the enforcement of the tax laws would cause irreparable damage or violate any constitutional provisions. Justice Kawu emphasized that fiscal policy and economic reforms fall squarely within the lawful authority of the government.

"I have considered the application together with the affidavit in support," the judge stated in a certified true copy of the ruling. "I have also considered the submission of the learned counsel for the claimant/applicant together with the judicial authorities cited and I am of the strong view that the court lacks power to stop implementation of a law already signed by the appropriate authority without concrete evidence of any wrongdoing."

Reforms to Proceed as Scheduled

The court affirmed that disagreements over tax legislation do not automatically justify stopping its enforcement once it has been validly passed into law. Justice Kawu noted that any perceived errors in an existing statute can only be corrected through a legislative amendment or a substantive court decision after a full hearing, not via an interim application.

Consequently, the judge ordered that the reforms should proceed as scheduled, finding no legal barrier to their commencement. The ruling explicitly stated that the implementation of the Tax Act 2025 and related acts will commence on January 1st, 2026, and remain in force pending the hearing and determination of the substantive suit.

This decision means the new tax regime is now legally cleared to take effect while the main case continues before the court. The ruling represents a significant victory for the Federal Government's efforts to overhaul Nigeria's revenue generation framework.

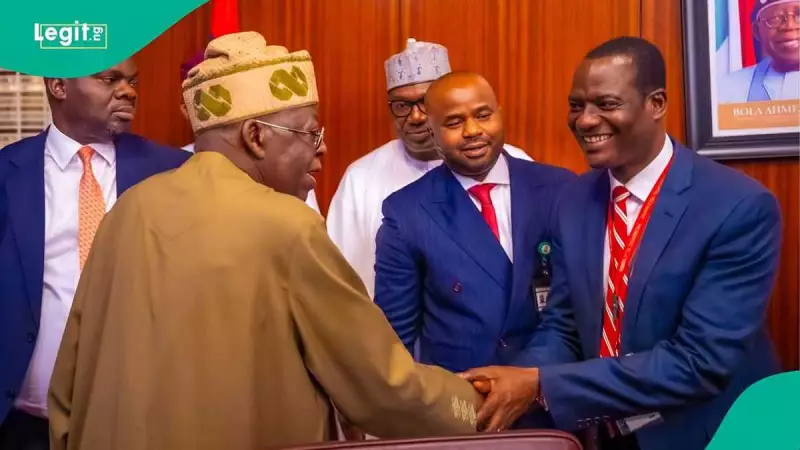

The tax reforms have been a central pillar of the government's economic strategy, aiming to streamline tax collection, expand the tax base, and improve overall fiscal efficiency. The Presidential Committee on Fiscal Policy and Tax Reforms, chaired by Taiwo Oyedele, has previously sought to address public concerns, insisting the changes are not designed to impose higher tax rates arbitrarily but to create a more equitable and efficient system.