A Nigerian man has sounded the alarm on social media, providing what he believes is concrete evidence that the new tax laws have taken effect at the start of 2026. The concern arose after he noticed an unexpected deduction from his bank account following a routine transaction.

Unexpected Charge on New Year's Day Transaction

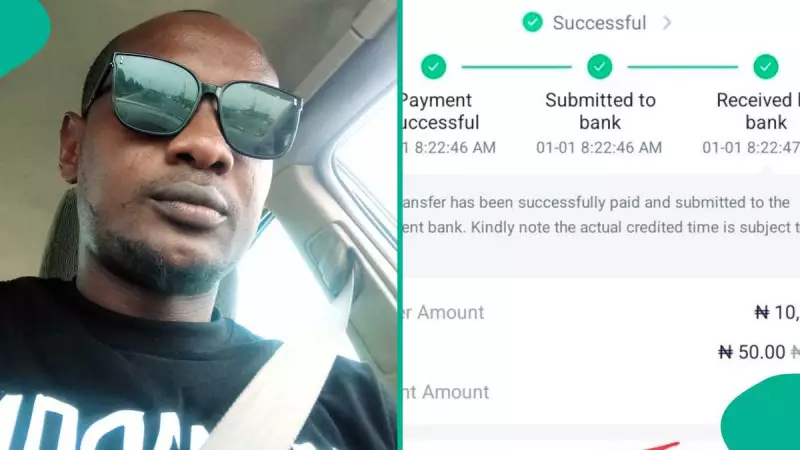

The Twitter user, identified as @Greatfuljoseph, shared his experience online. He explained that on the morning of January 1, 2026, he purchased an item and proceeded to transfer the sum of N10,000 to the seller. To his surprise, his account was debited a total of N10,050.

The extra N50 charge prompted immediate worry. @Greatfuljoseph interpreted this as confirmation that the controversial tax regulations, which the Federal Government had insisted in 2025 would proceed, are now active. He posted a screenshot of his transaction receipt alongside a message urging public attention to the matter.

In his tweet, he wrote: "Tax law has started ooooo I bought something this morning and wanted to pay the guy 10k and 50 naira charges was deducted from my account... are we going to keep quiet about this." He tagged several accounts to amplify his concern.

Understanding the N50 Electronic Money Transfer Levy (EMTL)

This development aligns with earlier reports regarding the implementation of the updated Tax Act from January 1, 2026. According to the new provisions, banks and financial institutions in Nigeria are mandated to charge a N50 stamp duty, known as the Electronic Money Transfer Levy (EMTL), on electronic transfers of N10,000 and above.

This levy is a one-off charge applied to the electronic receipt or transfer of funds. A key change from the previous system is that the fee is now deducted from the sender's account, whereas before it was often charged to the recipient. Fintech platforms like OPay, PalmPay, and Moniepoint had already alerted their customers to this change ahead of the new year.

Mixed Public Reactions and Concerns

The online reaction to @Greatfuljoseph's revelation has been mixed, sparking a debate on the policy's implications.

Some users, like @AlainShonibare, see it as a positive adjustment: "Great news!!!... starting from January 1st, 2026, this policy will undergo a positive adjustment: only the senders will be charged the ₦50 fee, while recipients will no longer bear any cost."

Others clarified the mechanics, with @bulu_kay stating: "This is not true. Both sender & receiver were not charged. Only the receiver was charged the stamp duty fee... the new law now puts the billing on the sender & not the receiver."

However, significant concerns have been raised about the broader impact. User @Secretingrident questioned the logic: "A 3% surcharge was placed on cash withdrawal... now electronic transfer (cashless) is being surcharged again! So which one do you want people to practice?"

Another user, @Wahala_Digest, pointed out a potential unintended consequence: "This charge, though small, might just push more people back to cash, making informal transactions harder to track for the government. It could unintentionally slow down financial inclusion."

The incident shared by @Greatfuljoseph serves as a practical, real-world example of the new fiscal policy touching the everyday lives of Nigerians. It has ignited discussions on affordability, the cashless policy's future, and the government's revenue generation strategies as the nation moves deeper into 2026.