Nigeria's proposed tax reform bills, set to take effect from January 1, 2026, have ignited significant debate, promising a fundamental shift in the country's fiscal federalism landscape. Lawmakers and analysts argue that the measures, designed to grant states greater financial autonomy and expand their revenue bases, could profoundly transform governance, infrastructure development, and public service delivery across the nation.

Core Objectives of the Fiscal Reform

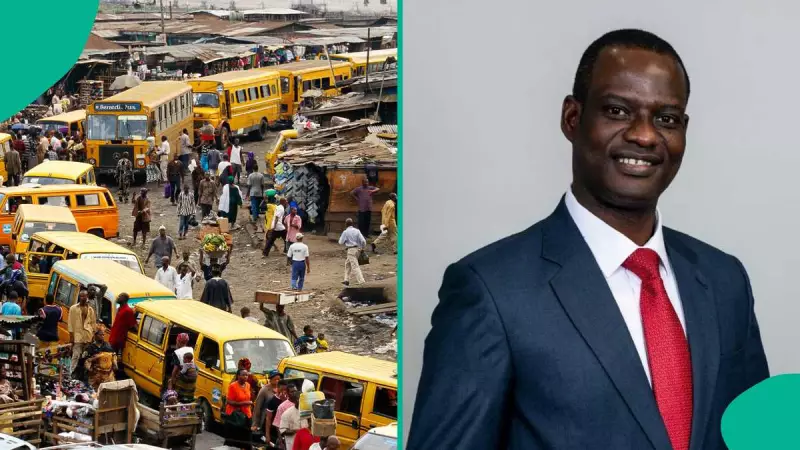

The reforms, championed by figures like Taiwo Oyedele and reported by outlets including Tribune Online, aim to modernise outdated laws and foster fairer tax administration. By redistributing tax revenues more equitably, the bills are expected to unlock substantial growth opportunities for subnational governments. This move represents a critical step towards strengthening fiscal federalism, balancing federal interests with tangible state-level empowerment.

Ten Pathways to State Enrichment

The legislative proposals outline ten specific mechanisms through which states stand to gain financially and administratively.

1. Revised VAT Revenue Allocation: A major change involves the Federal Government allocating 5 percent of its existing 15 percent share of Value-Added Tax (VAT) revenue directly to the states. This redistribution is a direct boost to state coffers.

2. Exclusive Electronic Money Transfer Levy: Revenue from the Electronic Money Transfer levy will be redirected exclusively to states, categorised under stamp duties. Analysts see this as a vital new income stream.

3. Modernisation of Stamp Duty Laws: The reforms will abolish archaic stamp duty laws, introducing a streamlined version. This modernisation is expected to enhance efficiency and increase revenue generation for states.

4. Taxing Limited Liability Partnerships: States will gain the authority to collect taxes from Limited Liability Partnerships, significantly widening their revenue base and tax jurisdiction.

5. Tax Exemption on State Bonds: Once passed by the National Assembly, the bills will enable state governments to enjoy tax exemption on their bonds, placing them on par with federal government bonds and encouraging more investment.

6. Equitable VAT Distribution Model: A new, more equitable model for VAT attribution and distribution is proposed, which is projected to lead to higher VAT income for states.

7. Integrated Tax Administration: This system will provide tax intelligence to states, strengthen capacity development, and expand collaboration. The scope of the Tax Appeal Tribunal will also be extended to cover disputes on state taxes.

8. Powers of the Accountant-General: The bills grant powers for the Accountant-General of the Federation to deduct unremitted taxes from government MDAs and pay them directly to the beneficiary state, particularly concerning Personal Income Tax of federal institution workers in states.

9. Autonomy for State Revenue Services: The reforms provide a framework to grant autonomy to States' Internal Revenue Services while enhancing the Joint Revenue Board to promote collaborative fiscal federalism.

10. Legal Framework for Lottery and Gaming Tax: A new legal framework for taxing lottery and gaming activities will be introduced, alongside withholding tax provisions, tapping into this growing sector for additional state revenue.

Broader Implications and Exemptions

Beyond empowering states, the broader fiscal reforms also offer relief to citizens. Officials confirmed that from January 1, 2026, new Personal Income Tax (PAYE) rules will exempt four categories of Nigerians, particularly targeting low-income earners, minimum wage workers, and small-scale earners to ease financial burdens and encourage compliance.

Authored by Basit Jamiu, a seasoned Current Affairs and Politics Editor with over five years of experience, the analysis underscores that these reforms, if effectively implemented, could mark a pivotal turn in Nigeria's economic governance, decentralising financial power and potentially accelerating development at the state level.