In a welcome development for many Nigerians grappling with the implications of a new fiscal policy, a discovery on the OPay mobile banking platform has sparked widespread celebration online. The find, which simplifies avoiding certain transaction charges, comes just days after the federal government's new tax law took effect.

Viral Discovery Eases Tax Law Concerns

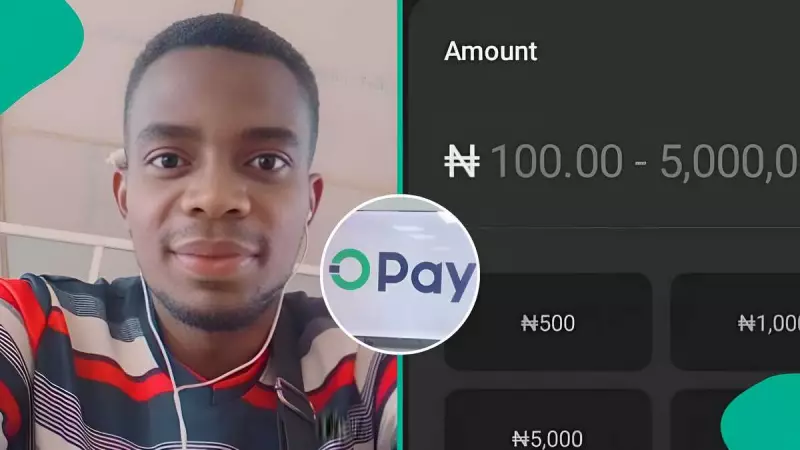

On Sunday, January 4, 2026, a social media user identified as @AnyasodorMark took to his platform to share a screenshot from his OPay app. He highlighted that the fintech company had introduced a specific transfer provision for 9,999 Naira. This move was widely interpreted as a direct response to user behavior under the new tax regime, which includes a stamp duty charge on transactions of 10,000 Naira and above.

"I just noticed @OPay_NG made provision for transfer of 9,999 as well for the new year... Opay dey think like Nigerians," he wrote in his post, which quickly garnered significant attention. His observation prompted a flood of other users to check their own apps, with many confirming the same feature was active on their accounts.

Public Reaction and Practical Savings

The online community reacted with a mix of appreciation and shared experience. User @plusone85 noted, "They noticed that many of us rather trf 9,999 instead of 10k. Recipients understand." This sentiment underscores a common practice that predates the 2025 law, where savvy individuals would send 9,999 Naira to bypass the stamp duty. OPay's formalization of this option was seen as a user-centric innovation.

Another user, @Pot_holes01, commented, "Opay really cares about us," reflecting the positive reception. However, some, like @ezekielndaka, expressed a desire for clarity, stating, "I want to see my 10k the way it used to be, no stories please." The reactions highlight the ongoing public adjustment to the new tax environment spearheaded by the Tax Reform Committee chairman, Taiwo Oyedele.

Context of the New Tax Law

The federal government had previously announced that the new tax bill would come into force on January 1, 2025. As the nation continues to digest the full scope of the legislation, actions by financial service providers like OPay are being closely watched. The company's introduction of this streamlined transfer option demonstrates how fintech platforms can rapidly adapt to regulatory changes and user needs.

This incident follows other viral stories related to the tax law and digital finance, including a man showcasing how he avoided bank charges on his first 2026 transfer and individuals sharing their savings experiences on the OPay platform.

The proactive step by OPay not only provides immediate practical relief for countless transactions but also sets a precedent for customer-focused adaptation in Nigeria's dynamic financial technology landscape.