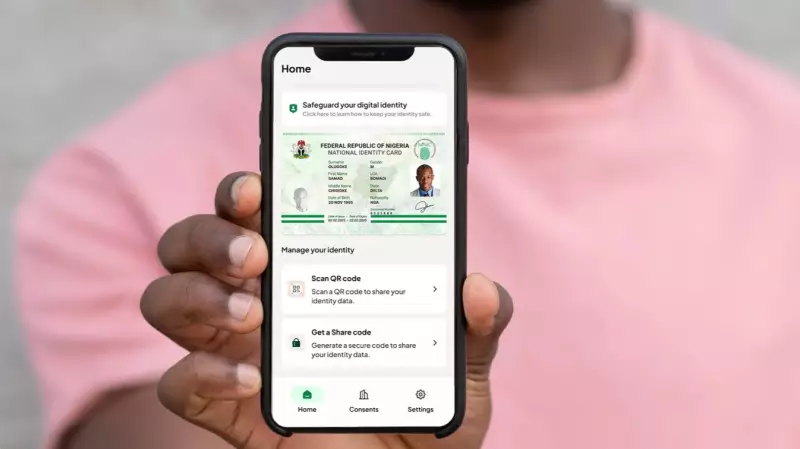

Nigeria has established itself as a leader in digital identity infrastructure in Africa, with a system built on the revolutionary principle of citizen control and consent. The launch of the NINAuth platform by President Bola Ahmed Tinubu on October 30, 2025, marked a pivotal shift in how identity technology serves the nation.

The Architecture of Citizen Consent

The core of NINAuth's design flips the traditional model of identity verification on its head. Instead of institutions having unchecked access to personal data, the system places power directly in the hands of Nigerians. When a bank or telecom company needs to verify an identity, the citizen receives a direct notification via the NINAuth mobile app. This notification details exactly what information is being requested and for what purpose, requiring an active approval or denial from the user.

This creates a transparent audit trail that every citizen can access. Furthermore, the system employs advanced tokenisation. This means your actual 11-digit National Identification Number (NIN) never leaves the secure servers of the National Identity Management Commission (NIMC). Instead, a temporary virtual ID is generated for each approved transaction. This crucial feature renders data breaches at third-party organisations far less damaging, as the stolen tokens have limited value and lifespan.

Privacy Built from the Ground Up

Unlike digital identity systems in some other nations, which added privacy features as an afterthought, Nigeria's framework was designed with data protection as a foundational element. This "privacy by design" approach avoids the pitfalls seen elsewhere.

India's Aadhaar, for instance, introduced consent mechanisms only after Supreme Court interventions, while Kenya's Huduma Namba faced constitutional challenges. Nigeria's model proactively separates biometric and demographic data, limits NIN proliferation, and mandates user consent at every step. These are not mere compliance features but are embedded into the very software architecture of the system.

The technical backbone is formidable. The verification engine connects in real-time to the upgraded Automated Biometric Identification System, managed in partnership with IDEMIA. This system holds biometric data for over 122 million Nigerians and has the capacity to perform one million fingerprint, facial, and demographic searches daily.

Transforming Lives and Boosting Inclusion

The true measure of this technological infrastructure is its tangible impact on everyday life. For financial inclusion, NINAuth is a game-changer. It enables secure remote customer verification, drastically reducing the cost for banks to onboard new clients. A woman in Maiduguri or a market trader in Aba can now open a bank account via mobile verification without ever visiting a physical branch. This is vital for reaching the estimated 60 million Nigerian adults currently excluded from formal financial services.

In governance, the system ensures efficiency and transparency. It helps guarantee that agricultural subsidies reach real farmers, student loans are disbursed to verified students, and social support programmes serve their intended beneficiaries. The forthcoming General Multipurpose Card, which will integrate identity with payment functions via the Central Bank's AfriGo scheme, promises to create a unified platform for citizen services.

The integration with all major telecom operators has also standardized and secured SIM registration. With 153 million SIM cards now linked to NINs, the platform provides the critical verification infrastructure supporting Nigeria's entire mobile sector.

Today, with 126.7 million Nigerians enrolled in the National Identity Management System and NINAuth processing a staggering 1.3 million verification requests daily, these numbers represent more than statistics—they signify lives impacted. As the National Identity Management Commission works toward its goal of 180 million enrollments by December 2026, the guiding principle remains clear: technology must empower citizens, not surveil them.