The persistent struggles of Nigeria's domestic airline sector are rooted in fundamental commercial and operational weaknesses within the carriers themselves, not just the country's harsh economic climate. This is the view of Gbenga Onitilo, Managing Director of Travelden, a subsidiary of Finchglow Holdings.

Beyond Macroeconomic Pressures

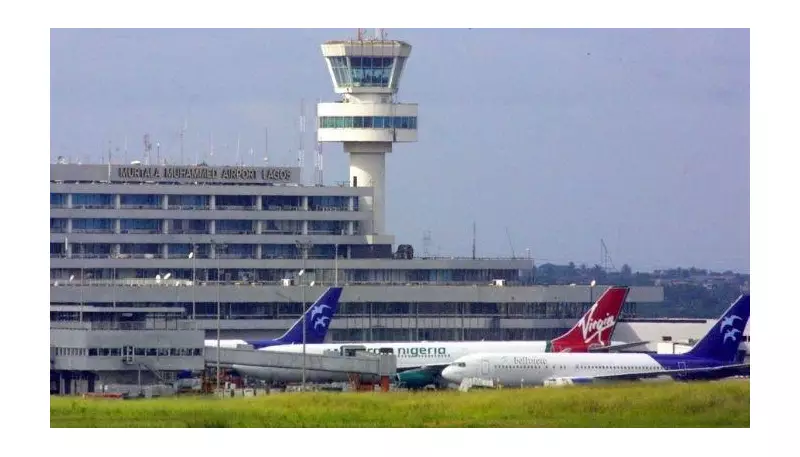

Speaking in Lagos, Onitilo acknowledged that issues like foreign exchange volatility, high aviation fuel costs, and infrastructure deficits are significant hurdles. However, he insisted the core problems run deeper. His analysis follows recent data from the Federal Airports Authority of Nigeria (FAAN) showing a 6.46 per cent decline in domestic passenger traffic for 2024.

Onitilo argued that this drop in traffic has exposed long-standing inefficiencies that were previously hidden during periods of high demand. He stated that poor commercial strategy and weak execution by the airlines themselves are major contributors to the ongoing downturn.

Operational Inefficiencies: Fleet and Staffing

A key weakness highlighted is the lack of fleet harmonisation. Unlike efficient global carriers that operate a limited range of aircraft types, many Nigerian airlines run fragmented fleets. This practice leads to:

- Higher maintenance costs.

- Complexity in sourcing spare parts.

- Inefficient deployment of flight crews.

Onitilo emphasised that globally competitive airlines carefully curate their fleets for cost discipline and resilience. He also pointed to staffing as a critical challenge, noting that several domestic operators maintain bloated workforces that do not match their fleet size or aircraft usage, contradicting international productivity standards.

Flawed Route Planning and Revenue Management

The commercial framework of the airlines also came under scrutiny. Onitilo observed that some carriers operate routes more for prestige than profitability. Poor frequency planning, inconvenient departure times, and operating thin routes without partnerships erode yields.

Perhaps the most critical gap identified is in revenue management. While modern airlines worldwide use dynamic pricing, demand forecasting, and inventory control to optimise income, many Nigerian airlines still rely heavily on simple fare increases to cover their inefficiencies.

"Dynamic pricing, demand forecasting, inventory control and segmentation are no longer optional; they are the nervous system of modern airlines," Onitilo stated, urging a shift to data-driven decision-making for sustainability.