A Nigerian entrepreneur has voiced her profound disappointment with the financial technology platform OPay after receiving what she considers a meager interest payment on a rigorous year-long savings plan.

The Year-Long Savings Challenge

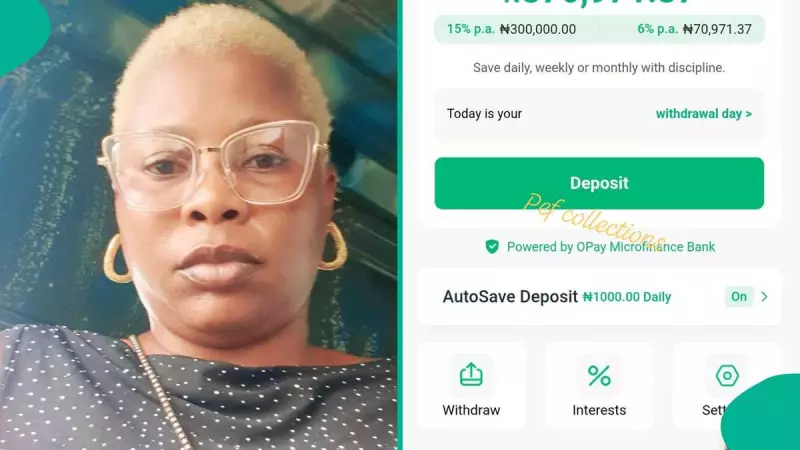

The user, identified as Daramola Abiodun, took to Facebook to share her experience. She disclosed that she diligently saved N1,000 every single day from January 1 to December 31, 2025, using the platform's Safebox feature. By the end of the year, her total principal savings amounted to N365,000.

However, upon completion of her savings challenge, OPay credited her account with an interest of just N4,000. After adding the interest, her total balance came to N370,971, which she has since withdrawn. In her online post, Daramola expressed being "flabbergasted," questioning the return on her consistent effort where she never missed a daily deposit.

Public Reaction and Financial Explanations

The lady's revelation sparked a wave of mixed reactions and explanations from other social media users, shedding light on how digital savings platforms often calculate interest.

One user, Modo Emmanuel, pointed out that the issue likely stemmed from compound interest calculations. He explained that depositing a lump sum of N365,000 at the beginning of the year would have generated a significantly higher return compared to daily incremental deposits, where interest accrues only on the existing balance each day.

Another commenter, Grace Isah, echoed this, clarifying that interest is calculated daily on the available balance. "When you had only N1k there, the interest you will get will be for N1k," she noted, emphasizing that the annual interest is not applied to the final total but to the fluctuating daily balance.

Alternative Saving Strategies Suggested

Some respondents suggested that the user might have chosen the wrong product for her goal. Adegbola Oluwasarafunmi Yemisi recommended using OPay's "Target" savings feature instead. She shared her own experience, stating that by saving a similar amount using Target, she received about N30,000 in interest. The Target feature typically requires setting a goal and allowing the app to deduct a fixed daily amount, often yielding a higher, pre-calculated interest if the schedule is maintained without withdrawals before the maturity date.

Other reactions were more pragmatic. User Kissval Onyeka Okonkwo advised focusing on the achievement of saving the principal itself, suggesting the money could be used for practical purposes like paying shop rent.

This incident highlights a common point of confusion among users of fintech savings apps regarding interest calculation mechanisms. It serves as a reminder for savers to fully understand the terms and computational methods of their chosen savings product, whether it's a flexible daily Safebox or a fixed-term Target plan, to align their expectations with the potential returns.