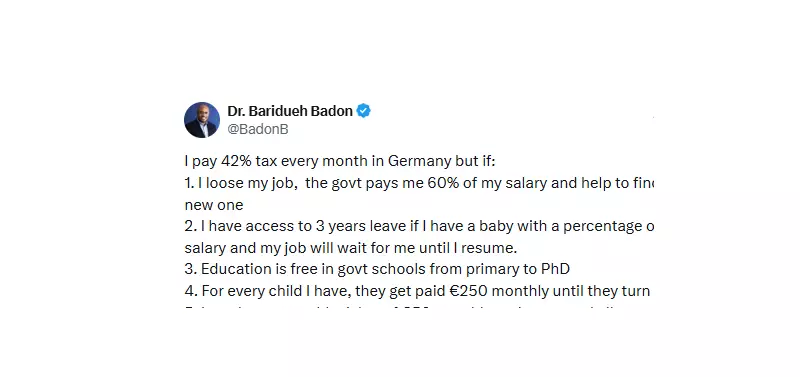

A Nigerian medical doctor practicing in Germany has ignited a significant conversation about taxation and citizen welfare by detailing the tangible benefits he receives in return for his contributions. Dr. Baridueh Badon used the social media platform X to outline the advantages that come with paying a substantial 42% income tax in his host country, directly contrasting it with the Nigerian experience.

From Unemployment Aid to Child Support: The German Social Contract

In his post, Dr. Badon provided specific examples of the social safety net funded by taxes. He revealed that if he were to lose his job, the German government would pay him 60% of his previous salary. Furthermore, the state actively assists him in finding new employment, ensuring financial stability during the transition period.

Another significant benefit he highlighted is the child support system. Dr. Badon stated that for every child he has in Germany, the family receives €250 per month. This financial support continues until each child reaches the age of 18, substantially easing the cost of raising a family.

A Pointed Question to Nigerians Amidst Tax Reforms

After listing these benefits, Dr. Badon turned his attention to his home country. He posed a direct and challenging question to his fellow Nigerians: what tangible benefits do you derive from the government after paying your taxes?

This query was particularly timely. It came just days after the Nigerian government introduced and began implementing a set of reformed tax laws, aimed at increasing revenue. Dr. Badon's comparison starkly highlighted the debate around the efficiency of tax collection and the visibility of returns on citizens' contributions in Nigeria.

The original post was shared on the platform on January 12, 2026, and has since sparked widespread discussion among Nigerian netizens. Many users echoed his sentiments, lamenting the perceived lack of commensurate public services and social security despite various tax obligations.

The Broader Implication: Accountability and Service Delivery

The viral post transcends a simple comparison between two nations. It taps into a core concern among Nigerian citizens regarding governance, accountability, and service delivery. The discussion underscores a demand for a clearer, more tangible link between tax payments and the provision of infrastructure, security, healthcare, and social welfare programs.

As Nigeria continues to refine its fiscal policies, the conversation initiated by Dr. Baridueh Badon emphasizes that public trust in taxation systems is built not just on compliance, but on the visible and equitable benefits returned to the populace.